EACs: Key to Supporting Energy Transition and Sustainability

As global efforts focus on restricting warming to 1.5°C, the energy sector, which contributes 73% of worldwide carbon emissions, remains one of the least transparent industries. Current tracking systems, plagued by substandard certificates, offer limited transparency and detail. Companies are investing over 13.4 billion euros each year in these annually traded energy certificates, exposing themselves to price fluctuations and significant risk. This lack of accountability impedes the advancement of a more efficient and sustainable energy market and transition.

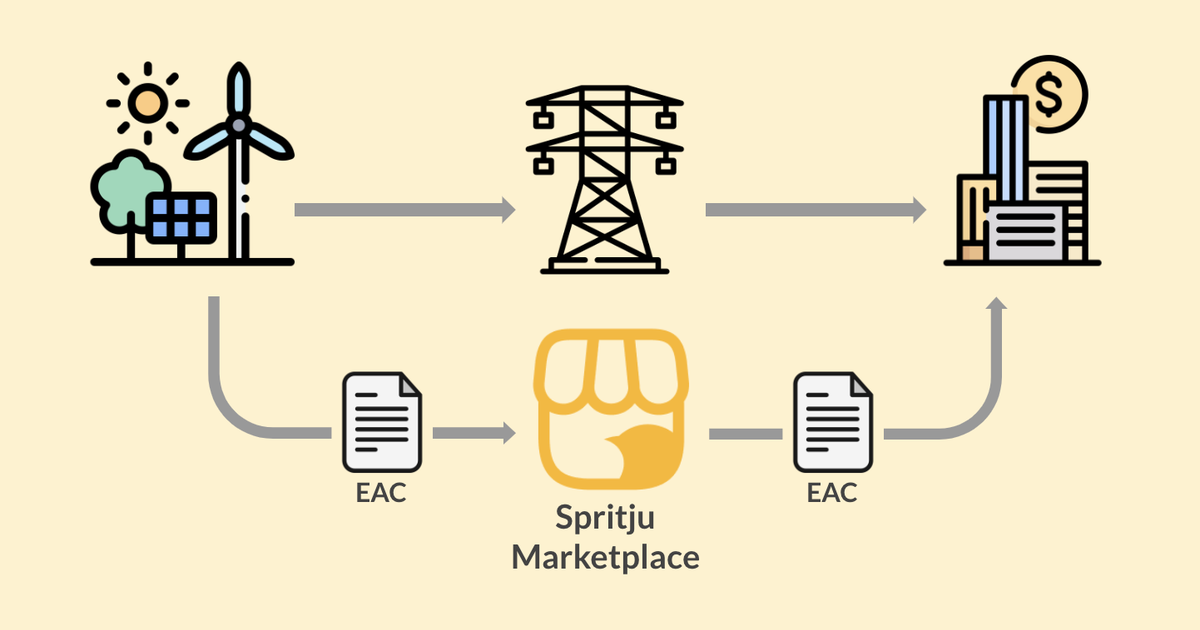

A crucial step in transitioning to a low-carbon economy is understanding how renewable energy purchases impact a company's carbon emissions. Energy Attribute Certificates (EACs) are key to accurately tracking Scope 2 emissions under the Greenhouse Gas Protocol’s market-based approach. This method directly reflects renewable energy use, reducing emissions and supporting renewable infrastructure growth. EACs verify that 1 megawatt-hour (MWh) of electricity was generated from renewable sources like wind, solar, or hydro. By purchasing EACs, organizations can claim the environmental benefits of renewable energy, contributing to the shift towards the energy transition.

EACs is experiencing rapid growth as both businesses and governments increasingly prioritize sustainability and set ambitious carbon reduction goals. This expansion is driven by rising demand for renewable energy, stricter regulations, and corporate sustainability efforts. In established markets like Europe and North America, systems such as Guarantees of Origin (GOs) and Renewable Energy Certificates (RECs) are widely used. Meanwhile, the market is also gaining momentum in Asia and other areas as more countries adopt renewable energy targets. The following table provides an overview of various EACs, highlighting their key features for easier understanding and comparison.

Energy Attribute Certificates (EACs) classified by geographic region

Navigating the market for EACs entails significant challenges and costs, despite their essential role in renewable energy purchases. The fragmented nature of the market, combined with a lack of transparency and the involvement of numerous stakeholders, complicates decision-making for companies. EACs are typically traded on a monthly or annual basis, which exposes businesses to price volatility and rising costs. While a correlation between electricity price and EAC price can be observed, EACs are traded in a decentralized and fragmented market that lacks modern market rules and structures. Consequently, prices can vary dramatically in response to fluctuations in wholesale energy markets and changing demand.

At Spritju, we provide a flexible platform designed to facilitate the trading and management of EACs. Our innovative solution not only enhances market-based accounting methods but also empowers businesses to effortlessly navigate the intricacies of the energy certificate market. Let’s explore the distinctive benefits that Spritju offers:

References

https://www.trackingstandard.org/

https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs

https://www.ofgem.gov.uk/environmental-and-social-schemes/renewable-energy-guarantees-origin-rego

https://cer.gov.au/markets/renewable-energy-certificates

https://www.chinadaily.com.cn/a/202408/01/WS66ab7b08a3104e74fddb8098.html

https://www.there100.org/sites/re100/files/2020-10/Chinese%20GEC%20Paper_RE100_2020%20FINAL.pdf

https://www.recregistryindia.nic.in/index.php/publics/AboutREC

Icons by Freepi