Responsible Consumerism in the Electricity Market

As the business world keeps on evolving, consumers tend to no longer be passive recipients of whatever power their utility delivers. Being reflected in the UN Sustainable Development Goals (SDGs) 12, responsible consumption and production, Consumers demand transparency, environmental integrity, and alignment with the causes they care about. Millennials, now 1.8 billion strong, are abandoning old-school brand loyalty to prioritise “purpose-driven” choices, and electricity is no exception [1][2].

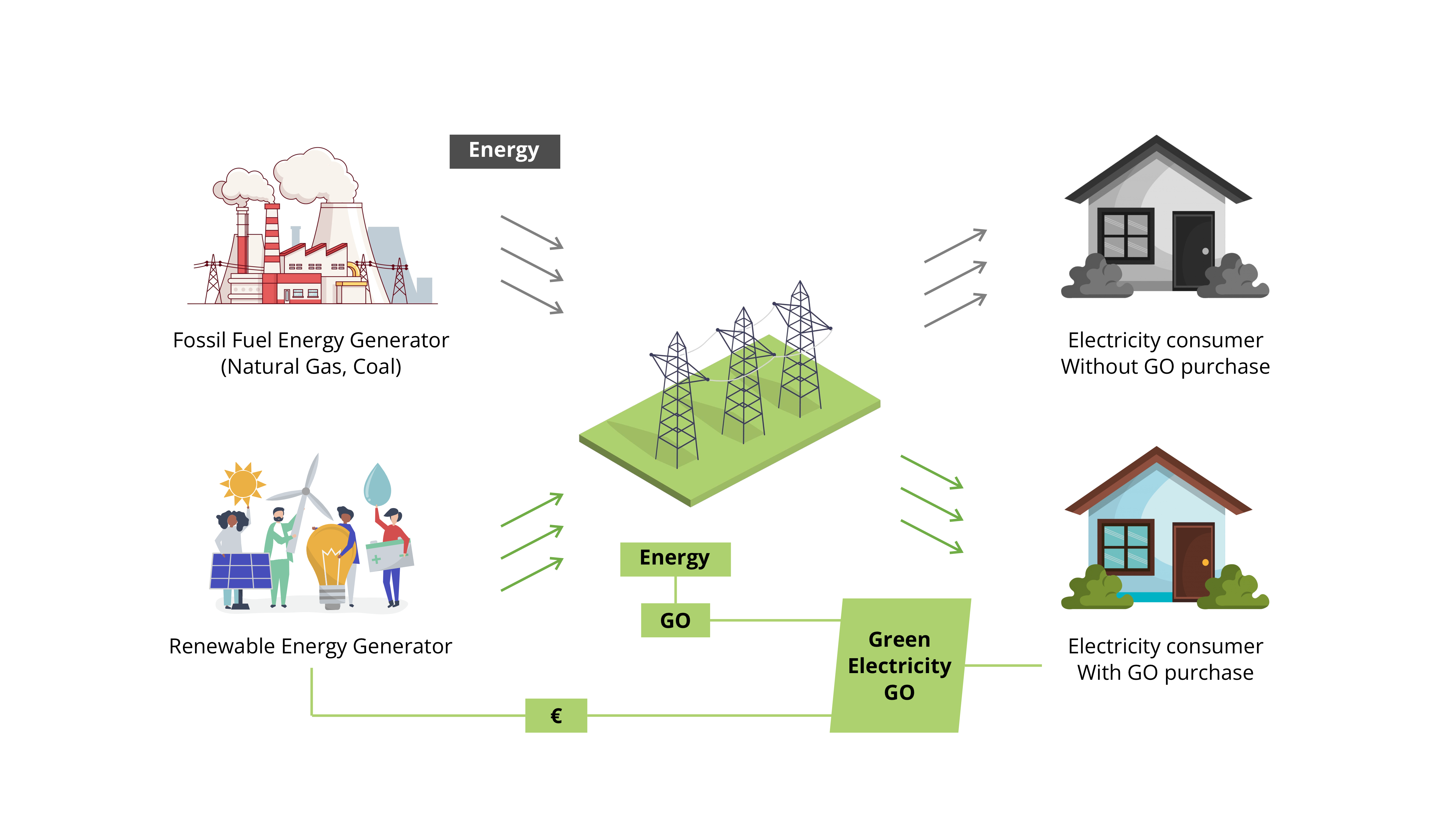

At the intersection of SDG 7 (Affordable and Clean Energy) and SDG 12 (Responsible Consumption and Production) lies Guarantees of Origin (GO or GoO), the EU’s go-to instrument for labeling renewable generation. It is simply a tracking instrument defined in article 15 of the European Directive 2009/28/EC , and later reinforced by the European Parliament in Directive (EU) 2018/2001 Article 19. Guarantees of origin are the only precisely defined instruments referencing the origin of electricity generated from renewable energy sources. Although a voluntary system, it complies with the Greenhouse Gas Protocol Scope 2 [3] Guidance and is an effective and recognized tool to reduce your greenhouse gas emissions and improve your sustainability rating. Following the green highlights in the image below, we see what GO electricity certificates are.

As a result, an electricity supplier that sells or uses renewable energy in its marketing must certify the origin of the electricity. Under the Renewable Energy Directive (RED II), every 1 MWh of renewable electricity can be tracked by a GO that records the source’s technology, plant location, commissioning date, and injection time [3][4]. Suppliers cancel the matching number of GOs to validate their green offers whether retail “green tariffs,” corporate Power Purchase Agreements (PPAs), or voluntary offset schemes [5].

Behind the scenes, the Association of Issuing Bodies (AIB) administers the pan-European EECS Hub, harmonizing GO issuance and cross-border transfers across 36 competent bodies in 28 countries [6]. The organisation satisfies the criteria of objectivity, non-discrimination, transparency and cost effectiveness, in order to facilitate the international exchange of guarantees of origin. In 2023, AIB members issued a record 185 TWh of electricity GOs and saw cancellations rise 7.6 percent year-over-year, driven by surging corporate demand and growing retail uptake [7]. But issuance outpaced cancellation, pushing GO prices down and weakening their ability to signal new investment [8]. This imbalance highlights three core challenges in the current GO framework:

Fragmented Disclosure Rules: Different Member States apply varied consumer-labeling regulations. In one market, a “100 percent green” tariff may rest on physical delivery from a local wind farm; in another, it simply reflects an equivalent volume of GOs purchased on secondary markets. The result? Confusion and eroded trust [9].

Price Volatility & Oversupply: As renewable capacity has flourished especially solar, GO issuances have surged. Without parallel demand growth or minimum price floors, GO valuations have dropped, dampening revenues for new projects and detaching price signals from real-world investment needs [7][8].

Weak New-Build Incentives: GOs are voluntary to cancel, and suppliers often source them from existing hydropower or biomass rather than commissioning fresh capacity. The lack of “new-build” differentiation within the GO pool means investors can’t rely on GO revenues alone to underwrite greenfield renewables [10].

Nevertheless, policymakers and market participants are already addressing these gaps with promising innovations:

- The EU's Renewable Energy Directive III (RED III) introduces special labels for renewable energy generated from new facilities built after 2025. This aims to encourage investment in new renewable energy projects by allowing consumers to identify and support fresh green energy sources. [11].

- To enhance transparency, the EU plans to implement a uniform template for energy suppliers. This template will provide consumers with clear information about their electricity, including the energy mix, origin, pricing impact, and any support schemes involved. [12].

- Projects like CertifHy III and REGATRACE are working to extend the Guarantees of Origin (GO) system beyond electricity to include renewable gases such as hydrogen and biomethane. This expansion will allow for similar tracking and certification of renewable gas sources, promoting their integration into the energy market. [13].

- Organizations like Energy Web and Eurelectric are exploring the use of blockchain technology to improve the GO system. Blockchain can provide a secure, transparent, and real-time method for tracking and settling energy certificates, reducing administrative costs and enhancing trust in the system [14].

For energy professionals, the rise of GOs means two clear actions: supply and trading teams must sharpen their procurement phase while focusing on new-build or technology-specific certificates to hit corporate net-zero targets. Retail marketers alongside sustainability officers should use the upcoming EU disclosure template to design truly standout green products. In today’s push for every kilowatt to count toward net-zero, Guarantees of Origin have graduated from a niche compliance checkbox to the very foundation of responsible consumerism.

At Spritju, we’re here to help you navigate this evolving GO landscape, build strong renewable credentials, and deliver high-integrity energy solutions that inspire trust. Subscribe to our bi-weekly newsletter for ongoing insights, or contact us now to see how Spritju can power your sustainable journey.

References

- Pamela Danziger, “6 Global Consumer Trends—and Brands That Are Out in Front of Them in 2019,” Forbes, Jan. 13, 2019.

https://www.forbes.com/sites/pamdanziger/2019/01/13/6-global-consumer-trends-and-brands-that-are-out-in-front-of-them-in-2019/ - “Completing a Transformation in the Consumer Goods Industry,” McKinsey & Company.

https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/completing-a-transformation-in-the-consumer-goods-industry# - Directive 2009/28/EC of the European Parliament and of the Council (Renewable Energy Directive I), Article 15.

https://eur-lex.europa.eu/legal-content/EN/ALL/?uri=CELEX%3A32009L0028 - Directive (EU) 2018/2001 of the European Parliament and of the Council (RED II), Article 19.

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32018L2001 - Adam Karnama, “Everything You Need to Know About Greenhouse Gas (GHG) Emissions Scope 2 Guidance,” LinkedIn Pulse, Jun. 2020.

https://www.linkedin.com/pulse/everything-you-need-know-greenhouse-gas-ghg-emissions-adam-karnama/ - Association of Issuing Bodies (AIB), “About AIB & EECS.”

https://www.aib-net.org/ - AIB, Annual Statistical Report 2023.

https://www.aib-net.org/document-downloads/aib-annual-report-2023/ - Montel Energy, “Guarantees of Origin Market Trends 2024.”

https://www.montelnews.com/news/municipalities/2024/01/15/guarantees-of-origin-market-trends - József Barta et al., “Consumer Information and Disclosure in the EU Electricity Market,” Energy Policy, Vol. 165, 2022.

https://doi.org/10.1016/j.enpol.2022.112922 - Ádám P. Tóth and Gergely Pánics, “Regulatory Failures in the EU Guarantee of Origin Framework,” Journal of Energy Law, Vol. 41, No. 4, 2021.

https://akjournals.com/view/journals/204/41/4/article-p487.xml

European Commission, “Proposal for a Directive on the Internal Market for Renewable and Natural Gas and for Hydrogen (RED III),” COM(2023) 241.

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2023%3A241%3AFIN - European Commission, “Draft Consumer Disclosure Template under Article 19 RED II,” SWD(2024) 85.

https://ec.europa.eu/energy/sites/default/files/redii_consumer_disclosure_template.pdf - CertifHy III & REGATRACE Project Overview, 2024.

https://www.certifhy.eu/79-slideshow/118-what-is-a-guarantee-of-origin.html - Energy Web & Eurelectric, “Blockchain Pilots for GO Settlement,” Energy Web Reports, Mar. 2024.

https://www.energyweb.org/publications/blockchain-pilots-go/ - International Energy Agency (IEA), “Renewables 2024,” Annex 3: Corporate Demand.

https://www.iea.org/reports/renewables-2024/annex-3-corporate-demand