CSRD Compliance: Complete Guide to Climate Transition Plans

In an era focused on climate urgency and growing social responsibility, the Corporate Sustainability Reporting Directive (CSRD) emerges as a powerful tool for aligning corporate behavior with sustainable development goals. Defined as a framework to enhance transparency and accountability, it guides businesses toward more sustainable practices while enabling informed investment decisions. Central to the CSRD is the principle of double materiality, which requires companies to assess both the impact of their activities on the environment and society (impact materiality) and the risks and opportunities that environmental and social changes pose to their operations (financial materiality) [1][2].

To support this directive, the European Sustainability Reporting Standards (ESRS) specify the detailed reporting requirements that companies must follow. These include both cross-cutting standards, which cover general environmental, social, and governance (ESG) disclosure expectations, and topical standards that address specific ESG issues. Among the topical standards, ESRS E1 requires the publication of a climate change mitigation or transition plan, revealing a company’s commitment to the EU’s broader climate and social objectives [3].

A Climate Transition Plan (CTP) can be best understood as a forward-looking strategy that outlines how businesses shift toward a sustainable economy. It requires the integration of climate considerations into both business and financial strategies, ensuring alignment with long-term sustainability objectives. A well-structured CTP includes actions such as improving energy efficiency, adopting renewable energy, and reducing Scope 1, 2, and 3 emissions while clearly identifying the sources of funding for these initiatives. In addition, companies must assess locked-in emissions which refer to future emissions from existing high-carbon assets to effectively manage long-term climate risks [4][5].

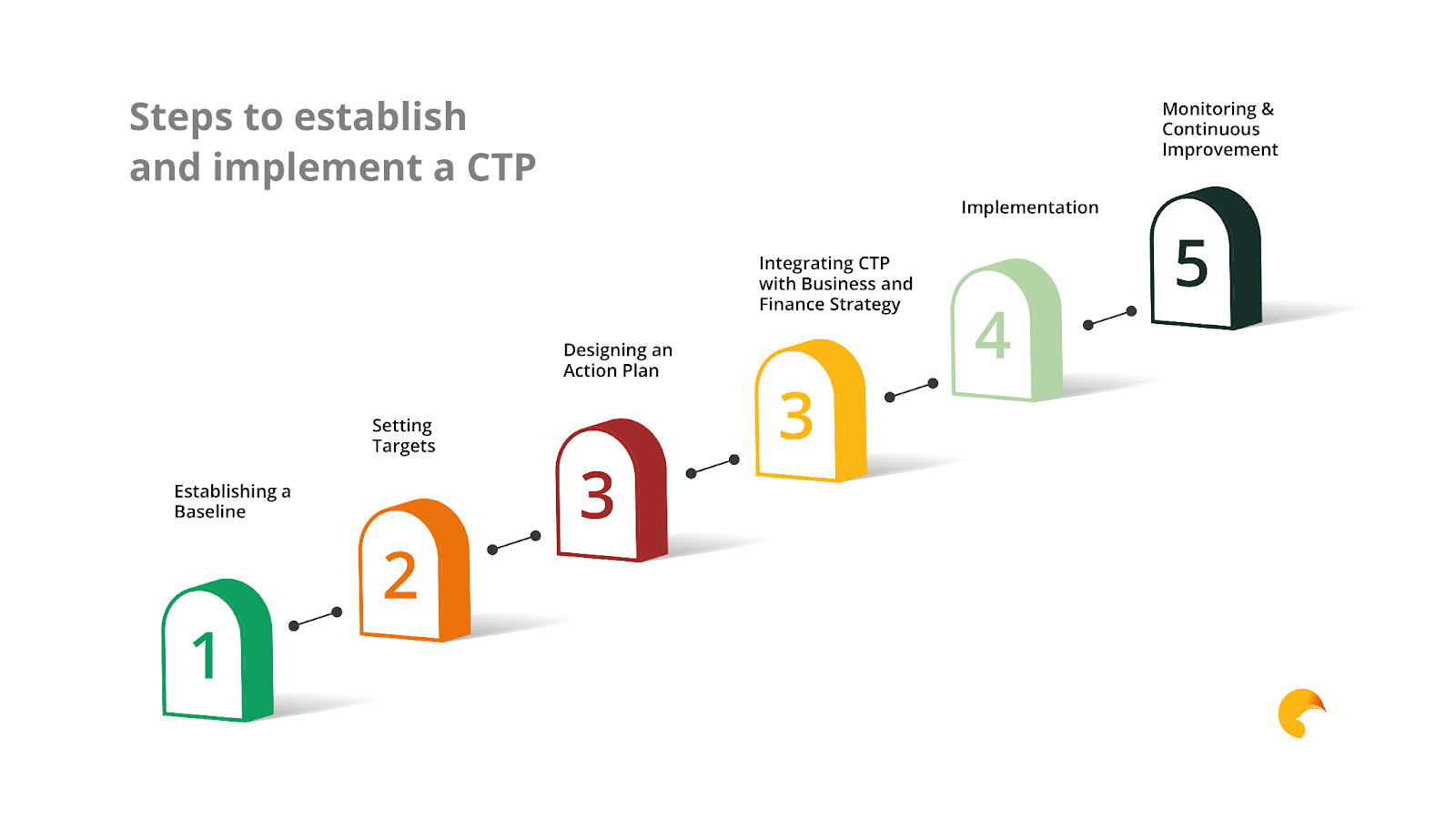

The general steps to establish and implement a CTP are as follows:

- Establishing a Baseline: Assess current Scope 1, 2, and 3 emissions to determine the starting point.

- Setting Targets: Define short, medium, and long-term goals for emission reductions and energy transitions.

- Designing an Action Plan: Develop a structured roadmap with specific actions to achieve sustainability targets.

- Integrating CTP with Business and Finance Strategy: Align the CTP decision-making processes. Ensure adequate funding for decarbonization efforts through both operational (OpEx) and capital expenditures (CapEx) [6].

- Implementation: Adjust processes, structures, and governance to meet climate goals. Engage the value chain by collaborating with suppliers and customers' awareness about sustainability.

- Monitoring & Continuous Improvement: Track progress with key performance indicators (KPIs) and refine actions to stay aligned with corporate climate targets.

In addition to these steps, it is important to understand the entire process, track accurate data, stay aligned with evolving regulations and standards, and fully integrate the plan into core business operations. Thanks to Energy Attribute Certificate marketplaces like Spritju, the process of establishing a CTP is done with ease and reliability. Powered by its Energy Traceability machine, it provides detailed insights into energy sources, consumption, and emissions, which helps companies to know their current state in terms of energy and permits them to easily set goals and establish action plans for their CTPs.

With its three core services, Spritju assists organizations in developing and implementing effective CTPs. Through its Advisory Services, Spritju provides expert guidance to help organizations navigate regulatory changes and align with internal sustainability objectives, including customized regulatory analysis, data strategy and implementation planning, and integration into existing corporate strategies and digital tools. Spritju’s Advisory Service helps businesses assess Scope 1 and 2 emissions, develop decarbonization roadmaps, and align CTPs with financial strategies.

Spritju’s Marketplace platform simplifies energy certificate trading, offering an advanced dashboard with rich insights into energy certificate data, tools to place, manage, and track buy/sell orders and energy portfolios, and the capability to generate granular (24/7 carbon-free) certificates for precise traceability and reporting.

Finally, Spritju’s SaaS solution delivers tailor-made software to digitize and scale energy traceability, enhancing granularity and analytics for energy certificates, integrating the Energy Traceability Machine into existing systems, and providing continuous updates aligned with regulatory changes to ensure future-proof compliance.

Combining strategic advisory, a liquid EAC marketplace, and seamless digital solutions, Spritju enables businesses to plan and implement CTPs and accelerate their transition to a low-carbon economy. As climate regulations and expectations evolve, Spritju is a trusted partner in building resilient and up-to-date sustainability strategies.

We hope you found this newsletter insightful! Stay ahead of the latest energy policy updates, EAC market trends, and industry innovations by subscribing to our bi-weekly newsletter and following Spritju on LinkedIn. Get exclusive insights, expert analysis, and real-time market updates delivered straight to you. Need tailored solutions for your clean energy strategy? Leave a comment or visit www.spritju.com to learn more! Together, let’s build a more transparent and sustainable energy future, one megawatt-hour at a time.

References

- Sustainable finance – Double materiality under the CSRD. European Commission. https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance_en

- Appendix 2.6 – Working Paper on draft ESRS 1: Double materiality perspective. EFRAG. https://www.efrag.org/News/Project-Page/27/Double-Materiality

- ESRS E1: Climate reporting requirements and ESRS E1. Carbon Direct. https://www.carbondirect.com/insights/corporate-sustainability-reporting-directive

- Climate Transition Planning. U.S. Environmental Protection Agency. https://www.epa.gov/ghgemissions/climate-transition-planning

- Corporate Sustainability Reporting Directive (CSRD) explained: Impacts inward & impacts outward. Normative. https://normative.io/resources/csrd-explained

- Basic Guidelines on Climate Transition Finance. International Energy Agency. https://www.iea.org/reports/basic-guidelines-on-climate-transition-finance