Exploring Blockchain and Its Applications in Energy

Blockchain is a Distributed Ledger Technology (DLT) that enables secure transactions and trading through strong encryption, business logic validations between multi parties/organizations, at increased speed and lower cost. That was complicated; wasn’t it? Let’s describe it in a simpler format. Imagine you and your friends decide to go to a restaurant together. How do you decide about a restaurant? You can either make a consensus together by voting or whoever solves a problem can decide or make this decision public so many other people can vote, and the result will be your final selected restaurant. In simple words, blockchain computerizes such a process and this can be applicable to many other series of processes (like where to go for beer after a restaurant or picnic the day after, etc.). So in simple words, blockchain is a tool to make consensus in situations when the trust between different parties is relatively low.

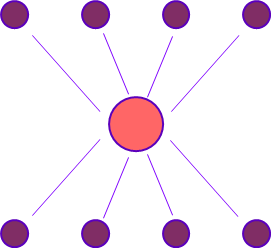

Blockchain facilitates compliance and governance through immutability, record timestamping, and non-repudiation. It is simply applicable when there is a lack of trust between the stakeholders involved. The traditional transaction model is shown in the figure below.

This is a multi-tiered transaction model relying on a central authority and the transaction data is primarily stored by the central authority. This is like a bank which certifies any financial transaction or a utility which certifies energy transactions. The main drawback of such conventional mode is the power of central authority which can be misused or not managed in a proper and trusted manner. Therefore, a blockchain transaction model is introduced in the figure below.

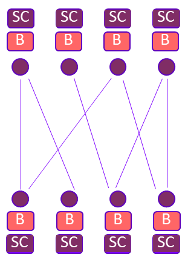

In this model, all transaction data is stored on a distributed blockchain, concurrently and continuously updated. These transactions are ideally executed in Smart Contracts. The data transaction is automated and decentralized in addition to the trust which is also automated within the blockchain protocol. The main advantage of blockchain is its nature to be distributed by design and eliminating single points of failure. The transparency at need-to-know basis and also trust are the main drivers to switch to blockchain systems. Finally, audit is made easy and undisputable (e.g. through immutability, nonrepudiation, etc.).

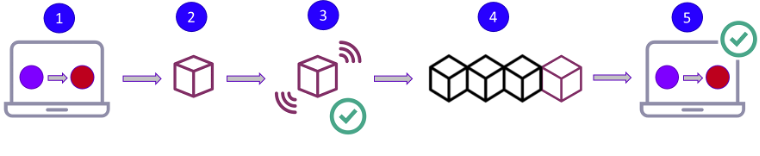

In the first step, a buyer and a seller enter a transaction or a deal/contract. Then in the second step, the transaction data is encrypted and combined with other transactions to form a block of data. The third step happens when the data block is broadcasted to the decentralized network and verified by a consensus algorithm. In the fourth step, the data block is ‘chained’ to other previously verified blocks, adding to the ‘blockchain’. Finally, in step 5, the transaction is confirmed, and the distributed ledger is updated accordingly.

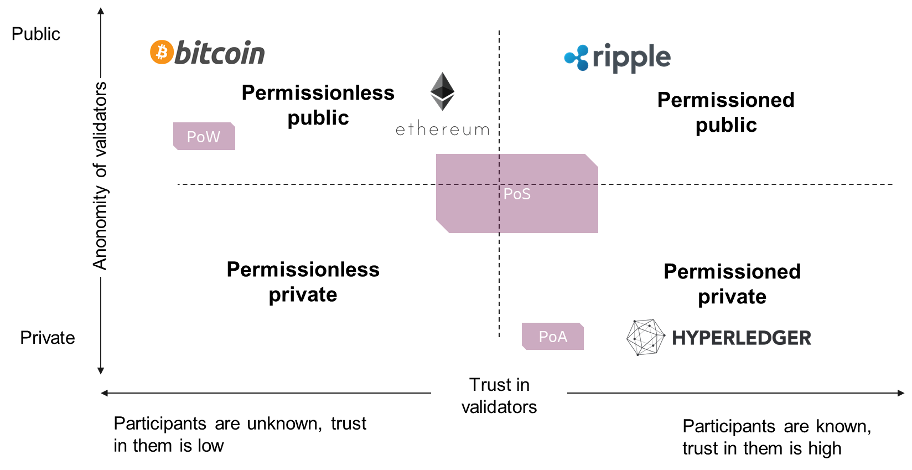

Not all blockchains are the same; blockchain platforms can be private or public and the degree of trust is dependent as well. For example, the most famous blockchain is bitcoin. Bitcoin is using Proof of Work (PoW) consensus function in the public domain when the trust in stakeholder is relatively low. Different types of blockchains are shown in the figure below.

It is a common misunderstanding that blockchain consumes a lot of energy. This is simply wrong. It is true that the most common blockchain application, bitcoin, is consuming a lot of energy and this is due to its specific consensus function, but this is not generally true or even close to be true. The different type of consensus functions and their potential energy intensity is shown in the table below,

|

Type of consensus function |

Energy Intensity |

|

Proof of Work (PoW) |

Can be high |

|

Proof of Stake (PoS) |

Low |

|

Proof of Authority (PoA) |

Low |

In Proof of Work (PoW), the so-called ‘miners’ solve computationally intensive puzzles to verify a block of transactions. As a result, the winning miners are rewarded. The process of solving can consume a lot of energy (like in bitcoin). The control of such a consensus function is distributed in terms of computational power.

In Proof of Stake (PoS), the responsibility for verifying transactions is determined as a function of ownership of a blockchain network’s assets. Consequently, the control of the blockchain is distributed in terms of stake in the network.

Proof of Authority (PoA) relies on identity, accountability, and reputation of validators to approve transactions. Therefore, this can only practically be applied to private, permissioned blockchains.

Great job that you could follow the article till this point! Congratulations! You should now get a good picture that blockchain is a tool to support us in situations when the trust is relatively low. One of the areas where trust is very low is about Copyright, IP (Intellectual property) and any other non-fungible goods.

NFT: Non-Fungible Tokens

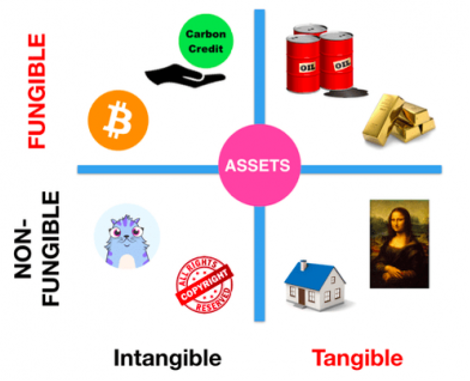

Goods can be tangible like a house, intangible like an IP. On the other hand, there is another dimension called fungibility. A good or asset which can be interchanged with other specific goods/assets of the same type, simplifying trade and exchange processes is called fungible. You can almost always interchange your 100 USD scan, gold or bitcoin with any other goods. However, you don’t have such a possibility for your hours or painting or your IP. This has been shown in the following figure.

“Non-fungible” more or less means that it’s unique and can’t be replaced with something else. For example, a bitcoin is fungible — trade one for another bitcoin, and you’ll have exactly the same thing. A painting, however, is non-fungible. If you traded it for a different painting, you’d have something completely different.

Fungibility is different from liquidity. A good is said to be liquid if it can be easily exchanged for money or another good. A good is fungible if one unit of the good is substantially equivalent to another unit of the same good of the same quality at the same time, place, etc. An apartment in the center of New York is a liquid asset but it is not fungible. On the other hand, your two-year-kid painting can be fungible, but it is not necessarily liquid!

OK, now that you understand the concept of fungibility, let’s go back to blockchain and NFT (Non-Fungible Tokens). I described before that blockchain is a tool to make consensus in low trust environments. Trade of non-fungible goods is one of the areas with the lowest degree of trust. How do you price your apartment? How do you get the right price for a painting from a semi-popular artist? This can go far more difficult if we talk about non-fungible non-tangible assets such IP and copyright. NFTs are here to address the problem of trading non-fungible goods. One of the recent and interesting trades of NFT is here: https://www.bbc.com/news/newsbeat-57227290

Blockchain in energy sector

Behind financial services, the energy industry is amongst the most advanced in its current adoption of blockchain. The use of blockchain technology within the energy sector is emerging as a key strategy and focus area for the industry. One of the areas in which there is a low degree of trust is the source of electricity. You can tag any good to be green or not but not electrons and the trust of private people and corporations on the source of electricity is very low.